From interpersonal connections to marketing options, Facebook has grown into a resource far beyond its initial intention. Today, it is a critical communication tool for small businesses, offering a platform to connect with target audiences and even use as a direct sales tool.

More than 200 million businesses use Facebook’s various apps every month to create virtual storefronts and reach customers. And since the start of the pandemic, millions have used them to help make the transition to a greater online presence. With so much data available through Facebook and its other related apps, Facebook has released a U.S. State of Small Business report, created in collaboration with the Small Business Roundtable, recapping some of its learnings from a survey of more than 11,000 business leaders, 8,000 employees and 6,000 consumers in late 2020.

We’ve said it before and we’ll say it again, we’re numbers people, so we love analyzing data that we can apply to our clients and the media strategy and buying services we provide them. After reviewing this State of Small Business report, here are some findings we consider most useful:

The Move to Digital

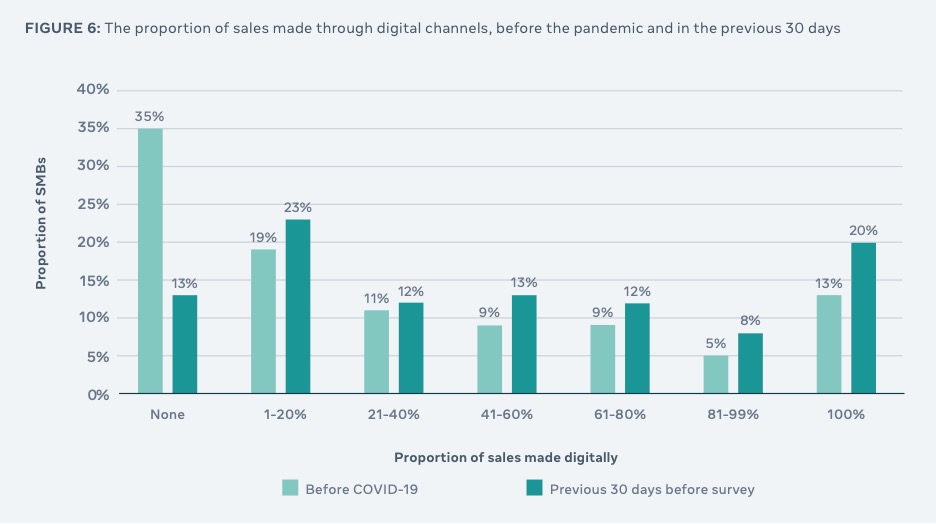

- The proportion of businesses making no sales through digital channels fell from 35%, prior to COVID-19, to 13% in December. This switch to digital channels has, in part, been driven by store closures and consumers switching to online purchases for safety and convenience.

- In response, SMBs (small and midsize businesses) have increased their use of digital technology by 60% in the share of purchases made by consumers through a digital channel between March and November (PYMENTS 2020).

- The shutdown of physical premises combined with changing consumer behavior is driving businesses to become more digital; 34% of businesses have increased their use of online or digital tools since the pandemic began, consistent with another research (Deloitte 2020). More female-led SMBs (37%) reported increasing their use of digital tools compared to male-led SMBs (30%).

- In addition, more businesses started selling online for the first time. The proportion making no sales through digital channels in the past 30 days fell from 35% before COVID-19 to 13% in the 30 days prior to the December survey, and the proportion making 100% of their sales online rose from 13% to 20% (Figure 6).

(Facebook U.S. State of Small Business)

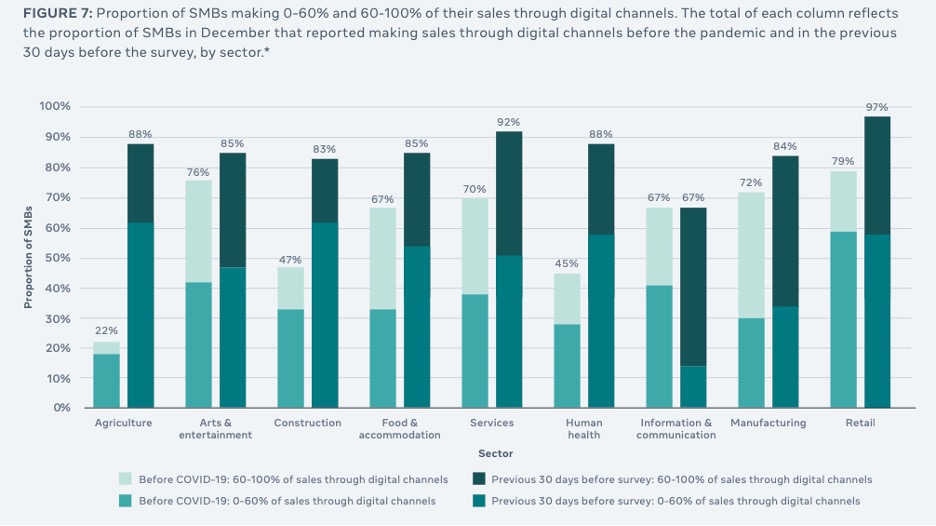

- Businesses across all sectors have benefited from this digital transformation (Figure 7). Among SMBs making their first sales through digital channels, the greatest increases were generally in sectors that had relatively lower levels of digitalization before the pandemic began. For instance, in agriculture, 88% were making sales through digital channels, compared to 22% before the pandemic. The sector with the largest increase in digital channels accounting for at least 60% of sales was in information and communication (27 percentage point increase), where one-third of all businesses made 100% of their sales through digital channels. Many businesses have also used digital channels to advertise. 57% of businesses reported that they use social media to advertise, second only to the number using word of mouth (59%). In addition, 38% reported that they advertised using their own website, 31% using internet search engines and 21% using other websites.

(Facebook U.S. State of Small Business)

SMB and Consumer Response

- SMBs have needed to respond and adjust to a different business environment to remain operating or to reopen. Businesses have adapted by, for instance, introducing social distancing measures (63%), changing operating hours (25%) and giving workers location flexibility (18%).

- As sales have fallen, SMBs have faced increased competition between businesses. 61% of SMBs reported an increase in competitive pressure compared to last year.

- The COVID-19 pandemic has also led to consumers shopping differently. 32% of consumers changed at least one of the businesses from which they regularly purchased in the past 6 months. When asked why, 38% of consumers cited health concerns as a reason for changing the business where they shopped. Similarly, 15% of consumers cited no delivery and 13% stated no online presence as their reason for switching. More female consumers (34%) than male consumers (29%) switched businesses and cited health as a reason why (45% of female consumers compared to 27% of male consumers).

- Consequently, more consumers have switched to shops with a digital presence. 32% of consumers reported a shift to shopping at an online business, second only to shifting to a local business (33%). Reflecting their increased health concerns, more female consumers switched to an online business relative to their male counterparts (37% compared to 23%) and to businesses observing social distancing practices (32% compared to 14%).

Closure Data

- While government restrictions are cited as the main reason for SMB closures, a greater proportion of businesses now report closing due to financial challenges and lack of demand when surveyed in December 2020.

- In December 2020, only 37% of closed businesses expected to reopen within 6 months, compared to 66% that expected to reopen in April 2020.

- Closure rates were higher among female-led businesses (28%) compared to male-led businesses (22%). Domestic pressures also led to more female businesses closing or not reopening. Household-related reasons were cited by 16% of female business leaders as a reason why they closed, compared to only 8% of male business leaders, and were the most prevalent reason (28%) for female-led businesses that did not expect to reopen. Among personal businesses, nearly one-quarter (23%) of those led by women cited household reasons as to why they closed, compared to only 3% of those led by men.

- Among businesses that closed and subsequently reopened, the most common enablers for businesses to reopen were implementation of social distancing protocols (40%), customer support (31%) and the easing of restrictions (30%). More female-led SMBs have adopted social distancing protocols and online tools, whereas their male counterparts were more reliant on the easing of government restrictions.

To view the full report, click here (hyperlink: https://about.fb.com/wp-content/uploads/2021/02/US_SSMB_Full_Report.pdf).

In general, this survey’s data shows that SMBs are in a slightly better place between April and December 2020, with closure rates falling and fewer businesses reporting lower sales and employment. Armed with quantitative results like this allows good marketers to make informed decisions for their clients. If you’re ready to implement a marketing strategy and plan based on the latest data and trends in your industry, contact Morgan & Co. today.